Calculate paycheck based on salary

To answer many of these questions you will need to know how to calculate wages from rates to salaries for various different time frames. Taxes and deductions- 000.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Calculate the gross wages based on a net pay amount.

. Gross Salary 432000 43200 86400 10800 10800 10800. DOL is raising the total annual compensation requirement for highly compensated employees from 100000 per year to 107432 per year. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator.

Above wages are per. Then do a substantially equal distribution from the IRA. Fill out a Form W4 federal withholding form with a step-by-step wizard.

The MoneyGeek calculator allows you to run cost of living comparisons of expenses in nearly 500 US. These paycheck details are based on your pay info and our latest local and federal tax withholding guidance. If you need to figure out what your take-home pay will be create an Excel spreadsheet to calculate your paycheck with a handy formula.

Thats equivalent to 35568 per year for a full-year worker. Find your total gross earnings before deductions on your pay stub. You are factoring in as much as 30 of your paycheckbut what about taxes.

To calculate your maximum monthly debt based on this ratio multiply your gross income by 043 and divide by 12. If you are paid in part based on how many days are in each month then divide your annual salary by 365 or 366 on leap years then multiply that number by the number of days in the month to calculate monthly salary. If you save.

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. According to the US.

Federal government websites often end in gov or mil. DOL is increasing the standard salary level thats currently 455 per week to 684 per week. Total pay 000.

Hourly Wages to Convert Amount. Calculate the Gross Salary and Net Salary of the following salary components. Switch to hourly calculator.

Again you can determine how much the employees paycheck increases by dividing their annual salary by 52 weekly 26 biweekly 24 semi. Fist off when you retire roll the 401k to an IRA. Paid a flat rate.

Get an accurate picture of. Heres how those numbers break down based on age average income and monthly expenditure according to nationwide data. If you work in human resources you will need to be ready to answer a variety of questions regarding paychecks.

Bureau of Labor Statistics the largest bill consumers pay each month is for housing. Calculate your annual salary. Monthly wage to hourly wage 5000 per month 12 52 weeks 40 hours per week 2885.

How to calculate salary increase. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Biweekly salary and semimonthly salary payments both assume that you work 40 hours each week and you get paid for 80 hours each pay period.

The results of the calculation are based on the details you have entered. Every company has its own employment costs calculator to calculate how much spend on their salary pay based on job title job description and responsivity. Maybe you have an employee who took on new responsibilities or added a new skill or title.

To build it MoneyGeek combined data from the Council for Community and Economic Researchs Cost of Living Index employment data from the US. Calculate your annual salary with the equation 1900 x 26 49400. Annual salary to hourly wage 50000 per year 52 weeks 40 hours per week 2404 per hour.

Free salary hourly and more paycheck calculators. Because there is only one US. Instructions in this article apply to Excel for Microsoft 365 Excel Online Excel 2019 Excel 2016.

If you are paid 60000 a year then divide that by 12. Back Start over. For this purpose lets assume some numbers.

Not based on your username or email address. Check it out on the IRS web site. At least one times your salary by your 30th birthday.

Multiply this amount by the number of paychecks you receive each year to calculate your total annual salary. Then calculate monthly salary using semimonthly basis of payment for two weeks at 40 hours each. Take a shortcut and find your hourly salary rate by using the federal formula.

This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Net pay 000. Suppose you are paid biweekly and your total gross salary is 1900.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. Whether thats a mortgage or rent a large percentage of your salary. This guide will help you convert bi-weekly pay to an annual salary.

When the benefits calculator uses to evaluate job salary there may get pay different based on the company industry divided. The salary calculator estimates your net monthly salary based on financial personal and employment information you provide. How Your Paycheck Works.

Coffee shop employee jumps for joy as he receives first paycheck. Before sharing sensitive information make sure youre on a federal government site. How to calculate taxes taken out of a paycheck.

The gov means its official. How to calculate annual income. If your monthly pay is flat based on an annual salary then you would simply divide the salary by 12 to come up with the equivalent monthly wages.

If you are paid an even sum for each month to convert annual salary into monthly salary divide the annual salary by 12. Bureau of Labor Statistics and demographic data from the US. Weekly paycheck to hourly rate.

This estimation is only for informative purposes and under no circumstances may it be considered binding. One formula is based on your age another is like an annuity and I forget off the top of my head what the 3rd formula is. There are ways to tap a 401k IRA.

Gross Salary is calculated as. You might also offer a salary increase based on merit. The annual salary in our case is 50000 and we work 40 hours per week.

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Spreadsheet Template Life Planning Printables

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Salary

Salary Paycheck Calculator Take Home Pay Calculator Paycheck Calculator Pay Calculator Love Calculator 401k Calculator

Show Me The Benefits How To Compare Job Offers Beyond The Paycheck Job Offer Health Savings Account Student Loan Payment

Salary To Hourly Salary Converter Salary Hour Calculators

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

Salary Paycheck Calculator Payroll Calculator Paycheck City Payroll Paycheck Salary

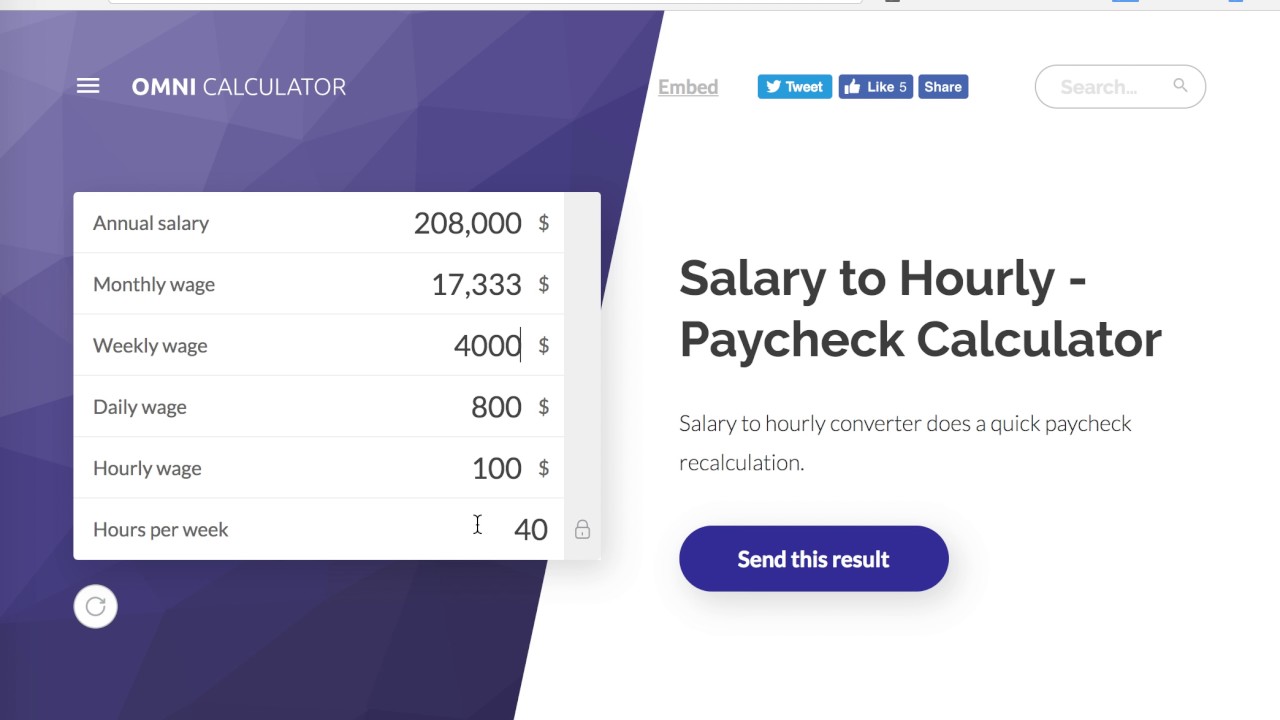

Salary To Hourly Salary Converter Omni Salary Paycheck Finance

Hourly Paycheck Calculator Hourly Payroll Calculator Payroll Paycheck Calculator

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live Salary Life Money Hacks Smart Money

Use Our Oregon Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Accoun Paycheck Salary Oregon

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Template Free Templates

Hourly Paycheck Calculator Hourly Payroll Calculator Hourly Wage Calculator Payroll Paycheck Wage

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Templates Paying

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator